Mortgage Hacks: Small Changes That Save Big Money

Managing a mortgage doesn’t have to be complicated, and it certainly doesn’t have to cost more than necessary. With just a few simple adjustments, Canadian homeowners can save thousands of dollars in interest, shorten their amortization period, and build equity much faster. The truth is, many of the most effective mortgage hacks are easy to […]

Complex Mortgage Guide 2026: What It Is and Who It’s For

Borrowers today often have multiple sources of income. Many are self-employed, purchase various homes, or earn from several streams, making conventional home loans insufficient for their needs. A complex mortgage is designed to help those who do not meet traditional lending requirements but still have strong financial stability. This blog will explain what a complex […]

Mortgage Default Insurance in Canada: What Homebuyers Must Know

Many Canadians are surprised to learn that if they put less than 20% down on a home, mortgage default insurance is mandatory. This insurance protects lenders if borrowers cannot make their payments, but it also opens the door for homebuyers to qualify for a mortgage with a smaller down payment. In this guide, we’ll break […]

Step-by-Step Guide to Getting a Mortgage for Debt Consolidation

Managing multiple debts with various interest rates and due dates can be hectic for homeowners. One effective way to regain control of finances is to use a mortgage for debt consolidation. This strategy allows homeowners to combine credit card balances, self-loans, and other debts into a single, manageable monthly payment. In this blog, we’ll explore […]

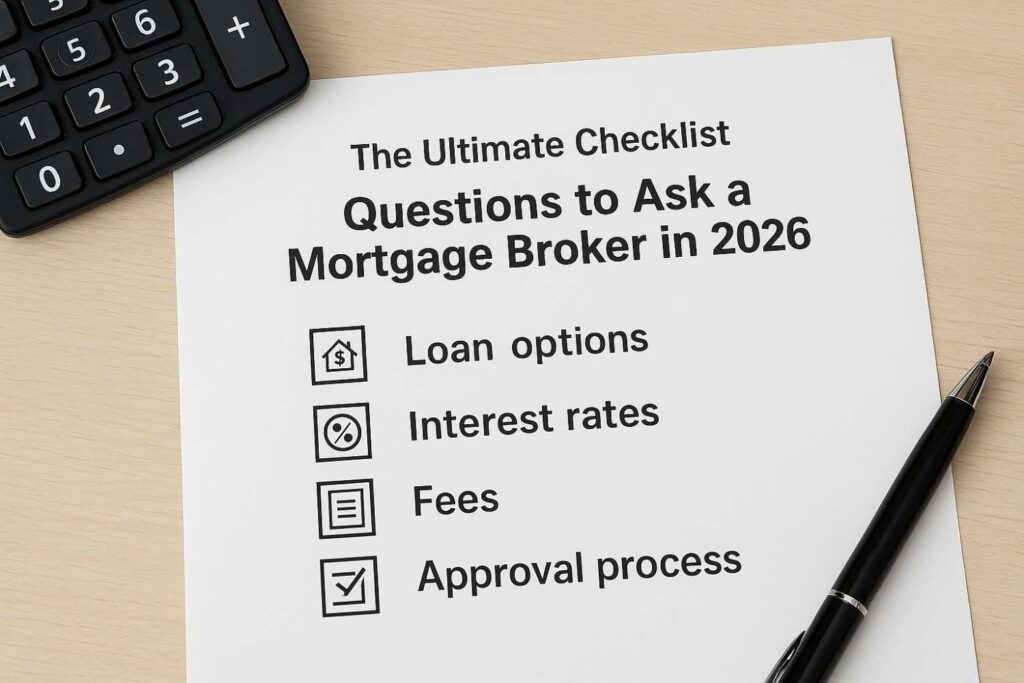

The Ultimate Checklist: Questions to Ask a Mortgage Broker in 2026

Purchasing a property is one of the most important financial decisions you will ever make, and navigating the mortgage process can often be time-consuming and overwhelming. This is where mortgage brokers come in! They simplify the home-buying process by linking you with lenders, negotiating reasonable interest rates, and assisting you in grasping sophisticated loan conditions. […]

5 Common Mortgage Myths Canadians Still Believe

Mortgages can be confusing, and many Canadians fall for common mortgage myths that could cost them thousands. Misunderstandings about laws, programs, and opportunities in the Canadian housing market often lead to missed chances or delayed homeownership. From misconceptions about down payments to myths around interest rates, prepayment penalties, and renting versus owning, these false beliefs […]

Fixed Mortgage Rate Explained: Is It the Right Choice for You?

Buying a home in Canada is one of the most significant financial decisions you’ll ever make, and choosing the right type of mortgage can significantly impact your long-term budget. Many Canadians prefer fixed mortgage rates for their stability and predictability, but is this option right for everyone? This blog breaks down the pros and cons […]

Second Mortgages: How They Work and When to Consider One

Homeowners in Canada have a range of mortgage options, from traditional first mortgages to more flexible lending solutions. Second mortgages have grown in popularity for those looking to tap into their home equity without refinancing their existing mortgage. Understanding how second mortgages work can help you make smarter financial decisions, whether it’s consolidating debt, funding […]

Mortgage Closing Costs: What’s Included and How to Save?

Buying a home involves more than just your down payment and monthly mortgage; there are also mortgage closing costs to consider. Understanding these expenses upfront helps you budget wisely and avoid last-minute surprises. In this guide, we’ll cover what mortgage closing costs are, the types you’ll encounter, how to calculate them, expert tips to reduce […]

A Step-by-Step Guide to Renewing Your Mortgage in Canada

When purchasing your home, you would have signed a mortgage with a set amortization period of 15 to 35 years. However, the mortgage itself is usually divided into terms ranging from 6 months to 10 years, most commonly 2 to 5 years. If your mortgage is coming up for renewal soon, now is the perfect […]